Mobile Banking Apps Used By 1B+ People

A lot of us are already using online banking but there’s a natural next step and that is mobile banking. A recent report from Juniper estimates that mobile banking users will exceed one billion in 2017 (about 15 percent of all mobile users), almost 19% of mobile banking customers will be using tablets when making financial decisions, compared to only 9% in 2012.

The report states: “As consumer tablet adoption continues to rise, there will be significant migration of purchasing and transaction activity from laptops and desktops to tablet devices. Indeed, the development of the ‘couch commerce’ trend within the payments industry will be increasingly replicated within the banking industry.”

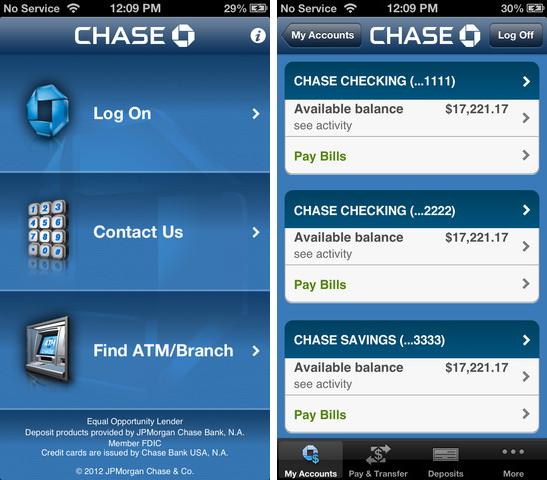

Banks can’t ignore these facts and must act and get their mobile groove on. Some of them have already started and deployed mobile apps strategies. One of the most known banking apps is Chase Mobile (SM) by JP Morgan Chase (iPhone, Android).

The app allows you to do banking 24/7, right from your iPhone or iPad. You can see account balances & transaction history or checkout your credit and debit card rewards status. Additionally you can perform transactions like paying bills, transfer money between Chase accounts, make deposits or send wire transfers.

The app helps you locate the nearest Chase branches & ATMs, it alerts you using push notifications of deposits, account balance levels and it lets you manage your Chase credit card.

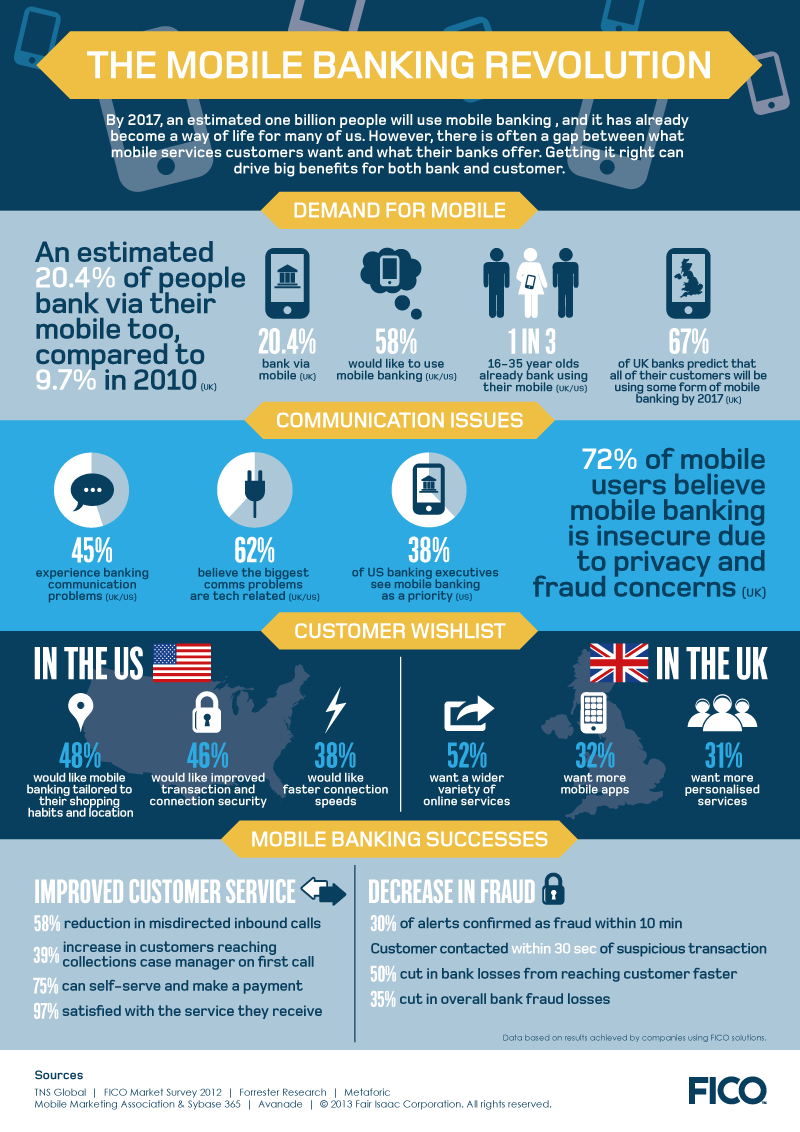

When looking at some statistics from a recent infographic by FICO, we observe that 1 in 3 people from 16-35 year old segment already bank using mobile and that 67% of UK banks predict that all of their customers will use a form of mobile banking by 2017.

However users still have to break their fear, it is estimated that 72% of mobile users think that mobile banking is insecure due to privacy and fraud concerns. Forty five percent of users experience banking communication problems, while 62% think that the biggest problems are tech related.

The infographic also revealed the customer’s wishlist:

– 48% would like mobile banking tailored to their shopping habits and location

– 46% would like improved transaction and connection security

– 38% would like faster connections speeds while 52% wish a wider variety of online services

– 32% want more mobile apps and 31% want more customized services

We’re living in an age where time is a very valuable resource, so technology will impact all areas where people will be able to save time and it will allow to do things easier, this includes banking of course.