How Mobile Apps Changed French Retail

Europe is a big market when it comes to online retail, this year being expected to surpass €150 billion, 81.3% of which is concentrated in the three largest markets – the United Kingdom, Germany and France. App Annie and Kantar Retail did a study on the state of mobile apps for retailers in France, and examined what mobile apps are doing in a market home to some of the world’s largest retailers such as Carrefour, E.Leclerc, Intermarché, Auchan or Casino Group. Mobile retail sales in France are expected to grow by 106% in 2014, rising to 13.5% of online retail.

Retailers are using apps now to remove friction and increase convenience in order to provide value and stand out from their competitors. French retailers have a history with convenience shopping, ten years ago Auchan pioneered Chronodrive, a service that promises to have orders ready within 2 hours of purchase and packed into consumers’ vehicles within 5 minutes of arrival.

The top large retailers’ apps can be categorized into two major groups — those that enhance consumers’ in-store experiences, and those that optimize out-of-store services. It is clear from the top apps that French app users opt for the convenience of distance shopping over enriched in-store shopping, that’s why Amazon comfortably topped the app rankings, offering consumers a complete online shopping experience, from browsing to purchase, through its app.

Offering a complete path to purchase within an app is a vital part of success in the French app market. In general, apps that offered a wide choice of products and in-app payment performed better than those that focused exclusively on special offers and do not allow the final transaction to take place in the app.

One app that is very popular is Monoprix Courses (iOS, Android), which offers over 15,000 products from food to beauty products. Users can choose to have the products delivered to their home or they can pick them up from the store within 24 hours.

Auchan is innovating m-commerce convenience with their Chronodrive app, by partnering with hiku, a small hardware device that allows users to add items to their shopping basket using barcode scanning or voice, without having to open the app or have a mobile device present.

There’s one major exception to the desire for convenience and full-service

shopping apps and that is the furniture sector. Retailers in this sector need to focus on discovery and connecting shoppers to information. One good example being IKEA (iOS, Android), who provides a digital catalog in their mobile app, as well as films and additional stories behind the products. Using Augmented Reality you can also place selected furniture from the catalogue in your own room.

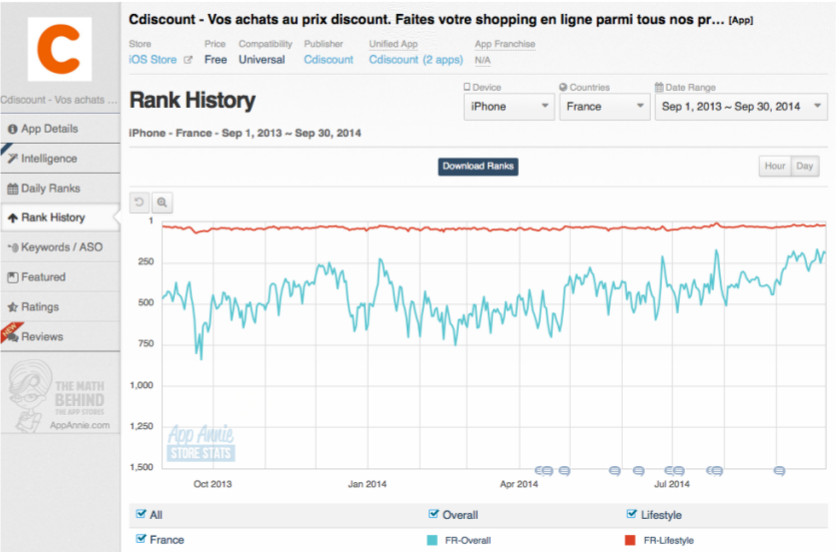

Quality matters in french retail apps and we can see this by looking at the average review scores of retailers’ apps and comparing it with their download performance. LeclercDrive (iOS, Android) leads the way both on iOS (4.5 out of 5) and Google Play (4.3 out of 5). An improvement in rating from 1.7 to 3.7, propelled Cdiscount from not being ranked in top 500 apps into 167th position.

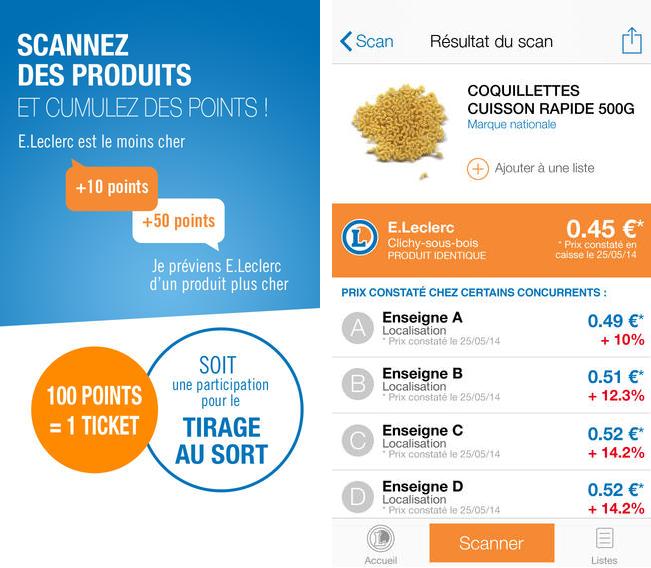

Mobile shoppers are sensitive to prices, almost all apps from the top 25 large retailers highlight special offers and many allow consumers to set alerts for specials on their favorite products. E.Leclerc’s “Qui est le moins cher?” (iOS, Android) finished Q3 2014 as the #2 app from large retailers in France, behind only Amazon. The app directs users to the cheapest location to buy products they are interested in.

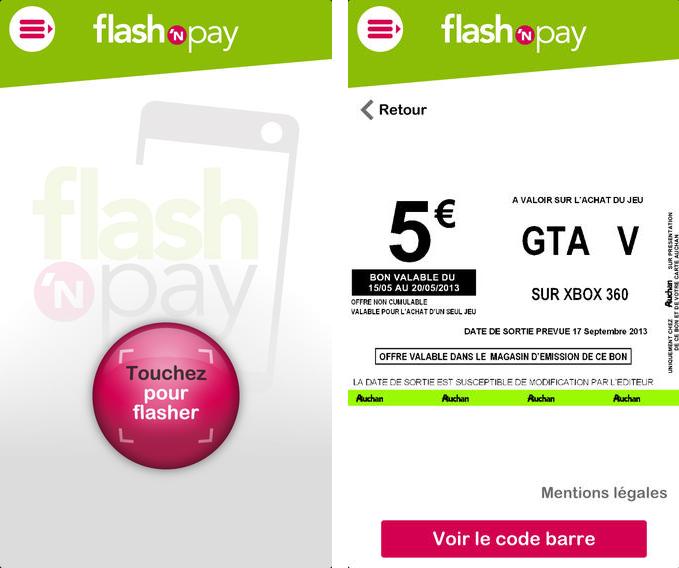

Mobile payments will accelerate growth in the retail sector. Retailers pay $150 billions every year in card payments fees, so the move to mobile payments is an attractive proposition. Auchan launched mobile wallet flash’N Pay (iOS, Android) and recently announced it will be rolled out to 120 hypermarkets by April 2015. Likewise, E.Leclerc introduced Paiement Flash for in-store payments.

Indoor proximity systems will improve the in-store experience. NFC-based systems and Bluetooth low-energy (BLE) beacons, allow retailers to provide personalized and location-specific information to consumers in-store. Casino’s mCasino and Carrefour’s C-où use NFC shelf tags to direct users in big store and allow users to view additional product information and see their shopping cart totals before arriving at the register.

Technology brings change, we saw what happened to Kodak when digital cameras appeared on the market and we’re currently seeing how smartphones are disrupting the digital camera sector, as more and more people user just their mobile device to take pictures. The mobile revolution will have a similar impact on the retail sector too, the retailers that benefit the most from the advancement of mobile technology will likely be the ones that are best able to adapt to the changing market and to seize most of the opportunities that arise.