9 Mobile Trends You Need to Know

Nowadays as consumers we are interested in new technologies, popular applications and trends. We ask questions, we want to know, we want to possess. The 2016 edition of the “Internet Trends Report” from venture firm KPCB is out with fresh and new information and for those of you interested in what they unveiled on Mobile, I’ve picked below the most interesting information.

The smartphone market has a lot of room to grow, smartphones represent only 35% of a 5.6 billion mobile users. This quarter was the smartphone industry’s slowest growth rate of all time. Smartphone growth is slowing due to increasing penetration maturity in major markets like China and US and consumer worries about the future of the world economy.

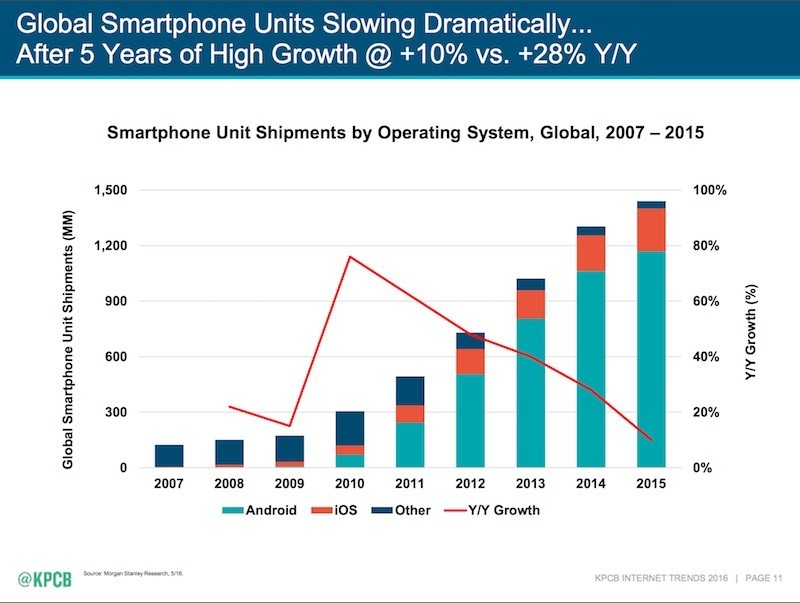

Unlike in years past, global smartphone unit shipments are slowing “dramatically,” for both Apple and Android devices. Expansion for the smartphone market as a whole has stagnated, going from a peak in 2010 at nearly 80 percent year-over-year growth, to just about 15 percent in 2015.

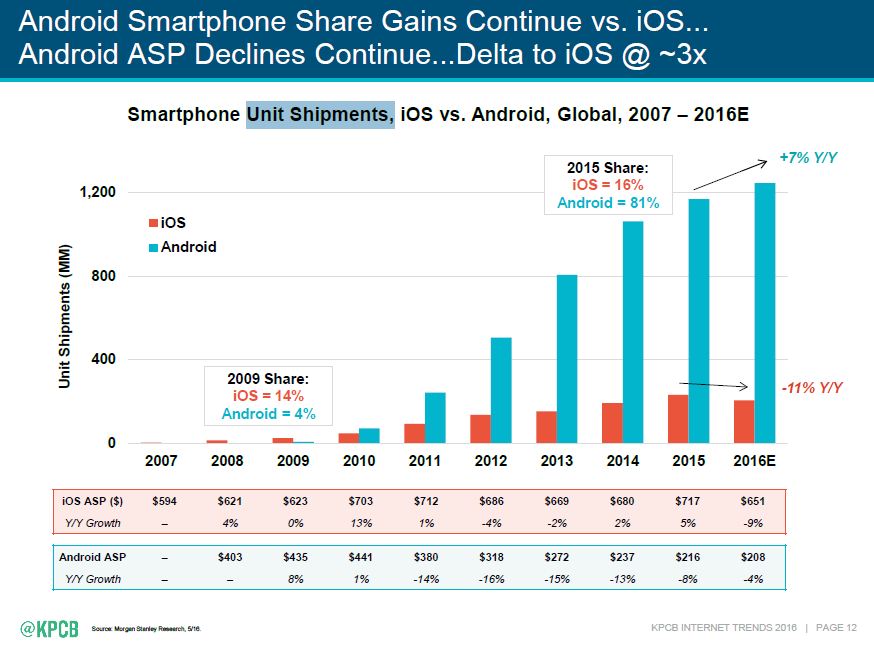

Concerning the specific battle between iOS and Android, Meeker notes that over the past six years iOS has seen just a two percentage point increase in market share, while Android has exploded from a 4 percent presence in the industry in 2009 to a massive 81 percent in 2015. The pattern is expected to continue, with Meeker projecting iOS will see a year-over-year loss of 11 percent in unit shipments as Android climbs another 7 percent in 2016.

Due to Apple’s introduction of the lower-cost iPhone SE — and the cheaper price tag of smartphones in the company’s expanding global markets — Meeker also expects Apple’s average selling price per unit to dip this year for the first time since 2012. In that year, ASP dropped only 4 percent (from $712 in 2011 to $686 in 2012), but now the company is predicted to see a 9 percent decline in ASP (dropping off from $717 in 2015 to $651 in 2016).

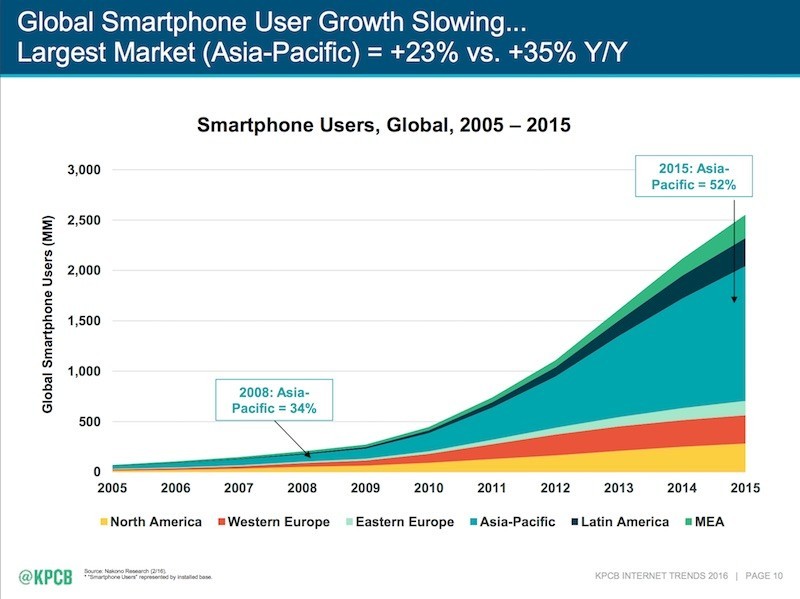

Global smartphone user growth is seeing a similar slow-down; understandably, the largest markets with the least amount of smartphone proliferation have the biggest upticks in year-over-year increments. These include Asia-Pacific, which has seen a nearly 20-percentage-point increase in smartphone user share over the last seven years and now accounts for over half of the total market.

Apple has been attempting to gain a larger foothold in these countries, notably seeing strong performance in China in recent years and looking toward India as its next area of focus. Low-cost devices — and a larger number of potential customers without a smartphone — in areas like the Middle East, Africa, and Latin America also presumably helped those territories come out on top in the total rankings for global smartphone user growth.

Earlier in April, Apple reported its first year-over-year decline in revenue since 2003. The news led to a string of reports addressing the company’s declining stock value and various “peak iPhone” comments concerning its potential inability to continue to grow in certain markets, especially where its flagship smartphones see annual releases without much dramatic distinction between models.

Meeker’s tamped-down expectations for 2016 mirror these concerns, particularly regarding the increasing belief that the 2016 iPhone 7 and iPhone 7 Plus will be iterative updates on the current iPhone 6s line, using a largely similar design but with new features like a dual-lens camera and Lightning-enabled headphone connector. An uptick is now projected for 2017’s “iPhone 8,” which is seeing rumors surrounding everything from a massively redesigned bezel free display that features a dual-curve OLED screen to truly wireless charging.

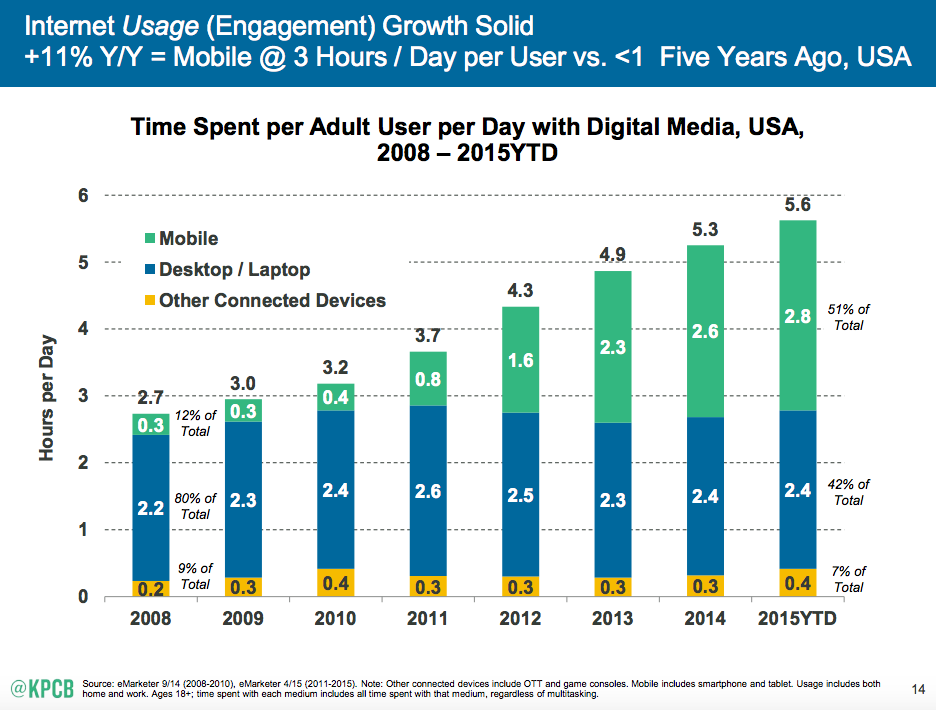

In terms of how much time do consumer spend on using mobile media, Mary Meeker’s annual spring updates on mobile are a must-read if you follow consumer adoption of technology platforms, so we have used some of the key findings from the latest KPCB mobile technology trends by Mary Meeker. The latest data shows that we are now well past the tipping point mentioned at the top of this post. Mobile digital media time in the US is now significantly higher at 51% compared to desktop (42%).

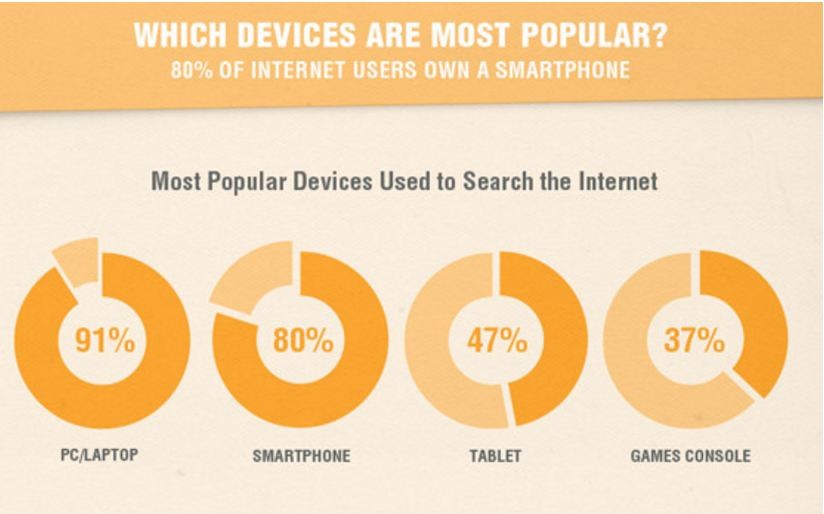

You’ve been curious to know what is the percentage of using mobile devices?

We’ve created a new summary showing the global popularity of using different digital devices using data from Global Web Index. It clearly shows the popularity of smartphone ownership and emerging mobile devices like Smartwatches.

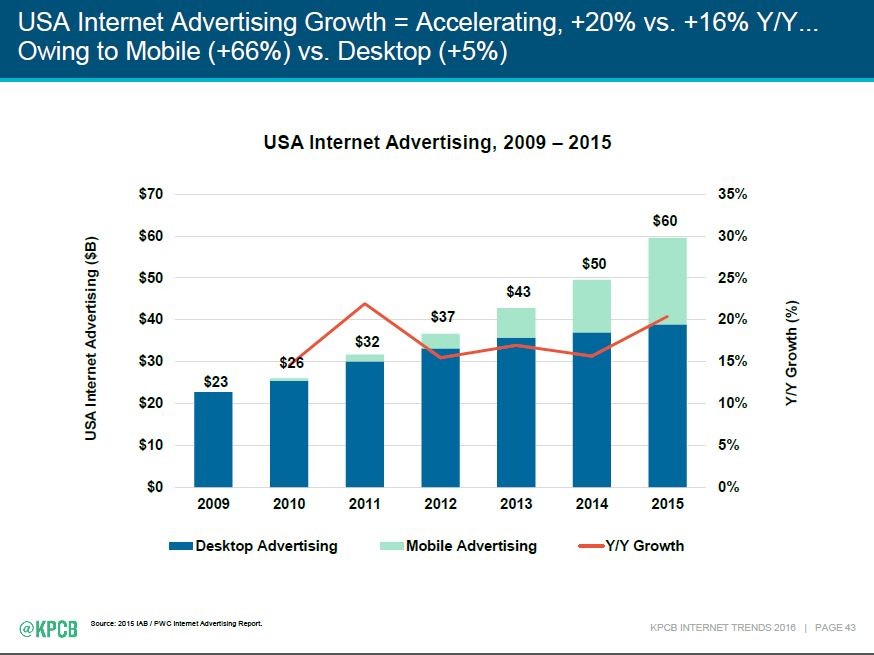

When it’s about Online Advertising, the mobile devices play an important role. From 2012 to 2014 the growth wasn’t so considerable but in 2015 it reaches the peak up to 20% and the spends are more than 60B$. Unlike in years past, the Internet Advertising growth it’s accelerating.

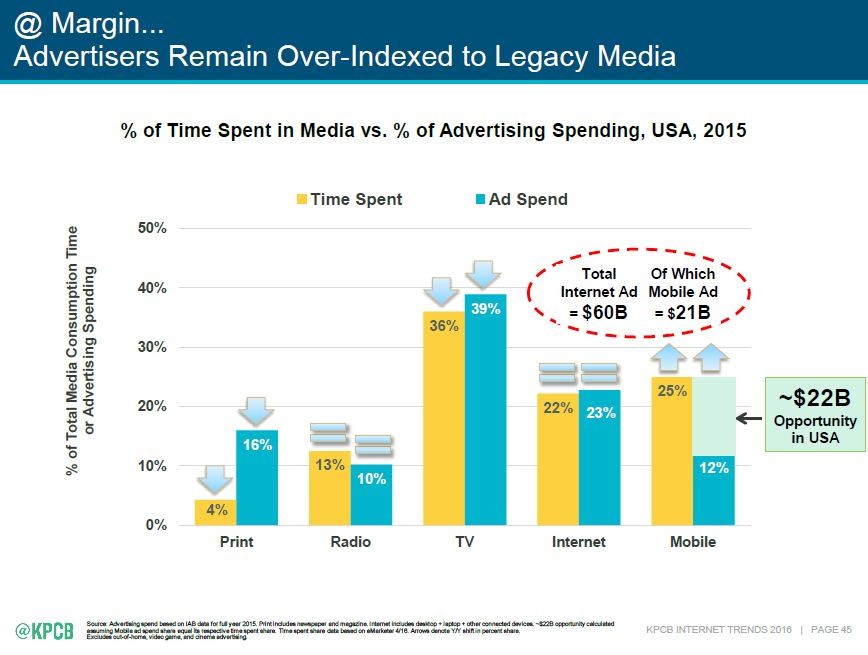

So, how have advertisers responded to the change in mobile media time? The next chart shows that despite the growth in media time above, some advertisers are missing out since the right-most bar shows that there is a huge missing opportunity on mobile advertising.

Messaging applications are also increasing and becoming the Second Home Screen.

With the rise of messaging apps and bots, the way many of us use social media to share and interact is fundamentally changing. As we progress through 2016, and beyond we’ll start to notice most social activity is no longer going to happen in public, instead transitioning to private groups and messaging apps. This represents a significant change in what “social media” is. As one-to-one messaging begins to dominate the social media world, it creates a whole host of new questions, challenges, and opportunities for marketers.

Since 2014, Facebook have made huge strides in the messaging space, acquiring Whatsapp for $19bn and building Messenger up to 900 million users worldwide.

When you take a look at the data, you can see why Facebook are putting such an emphasis on messaging apps and dark social, as reported by The Economist:

A quarter of all downloaded apps are abandoned after a single use. Only instant messaging bucks the trend. Over 2.5 billion people have at least one messaging app installed. Within a couple of years, that will reach 3.6 billion, about half of humanity. The market’s leading duo, Facebook Messenger and WhatsApp, which is also owned by Facebook, are nearing one billion monthly users each. Many teenagers now spend more time on smartphones sending instant messages than perusing social networks. WhatsApp users average nearly 200 minutes each week using the service.

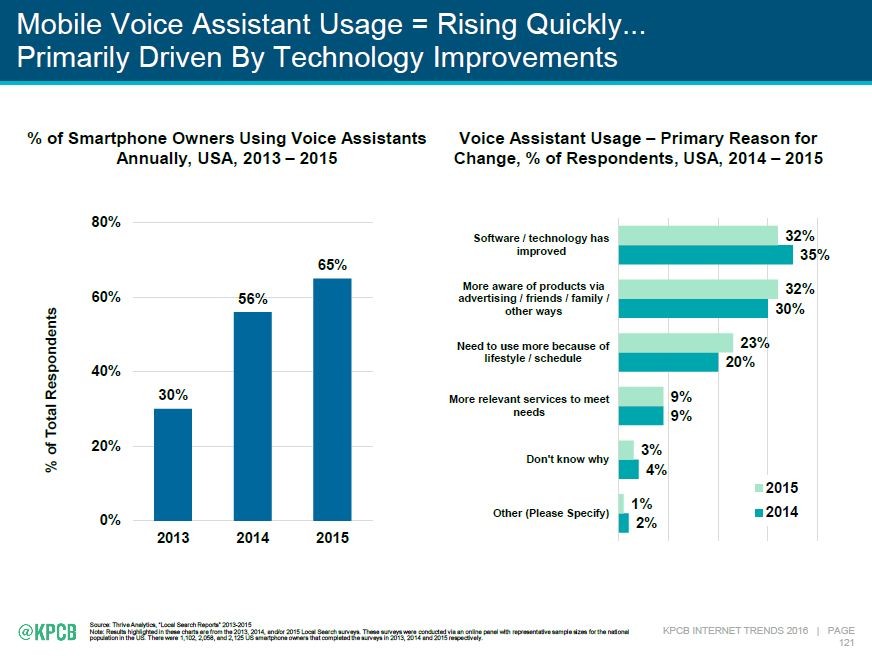

Do you still remember Siri or other Voice Assistants?

Well take a look and see how those assistants are rising so quick and they improve your lifetime, they make to be more productive and efficient. In the last years the usage of this technology raised with more than 20%.

What do you think of these trends? Have you noticed anything surprising? Please let us know in comments.